VIP number plate: Now you may have to pay 18 or 28% GST to get a fancy or VIP number plate installed in your car – Source

VIP Number Plate: If you are fond of fancy or VIP number plate in your car, then you may have to pay 18 or 28 percent GST on purchasing it. The GST rates of about 100 such items are to be reviewed in the meeting of the Group of Ministers to be held on October 20. Giving more information on this special news, CNBC Awaaz correspondent Alok Priyadarshi said that everything can be reviewed in the meeting of the Group of Ministers on GST on October 20. GST is possible on auction of fancy number plates of cars in the big meeting on GST to be held on Sunday. According to sources, there may be a discussion on imposing GST on VIP number plates in this meeting.

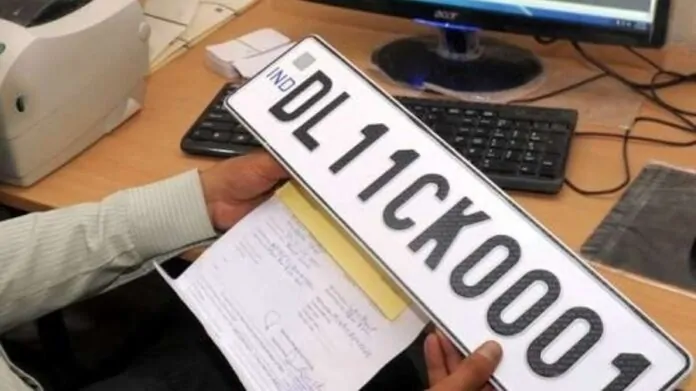

According to information received from sources, Uttar Pradesh government has suggested imposing GST on fancy or VIP number plates in cars. Let us tell you that the regional transport offices of the states are responsible for distributing the special numbers. Separate money has to be paid for this. There is an auction for fancy numbers. Bids worth lakhs of rupees are placed in this. At present states believe that the number plates issued by them are exempt from GST. Many such cases have come to light, where fancy number plates or registration numbers preferred for vehicles have been auctioned for several lakhs of rupees. Sources said that in some cases, single numbers of these fancy number plates like 0007 or 0001 etc. have also been auctioned for more than Rs 20-30 lakh.

Apart from this, discussion is also possible on increasing GST on selected white goods. According to sources, it is possible to consider increasing GST on hair dryer and dishwasher in the meeting to be held on October 20. At the same time, it is also possible to consider reducing GST on footwear and textiles. According to sources, GST on 100 products will be reviewed in this meeting. These also include white goods and food items. Suggestions received from different states will be discussed in the meeting.

Comments are closed.