Zepto files $1.22 billion IPO in India: Here’s everything you need to know

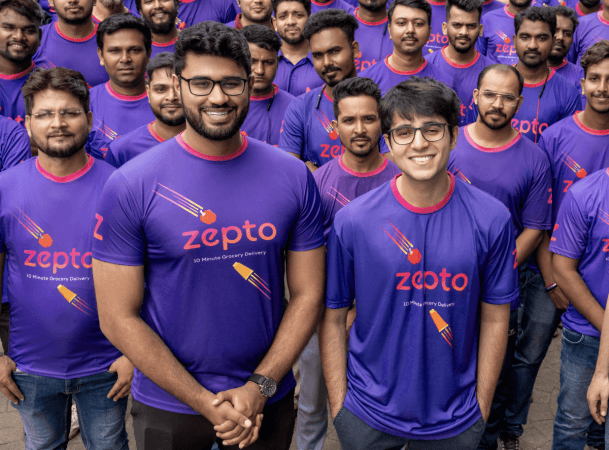

Zepto, an Indian quick commerce company, has made waves in the business world by filing for an initial public offering valued at 110 billion rupees ($1.22 billion) through the confidential route. This move, announced on Monday, is setting the stage for what many anticipate to be one of the most eagerly awaited listings in India in 2026.

The quick-commerce sector in India is currently witnessing intense competition, with companies vying for a larger slice of the market by expanding their presence and offerings to cater to the fast-paced lifestyles of urban consumers. Zepto, which was established in 2021, has quickly gained traction by providing a wide array of over 45,000 products, competing with industry rivals like Eternal’s Blinkit and Swiggy’s Instamart.

Based in Bengaluru, Zepto’s value soared to $7 billion following a successful funding round in October, during which they secured $450 million in investments. In a strategic move to further establish its presence in the market, Zepto opted to go public, filing for an IPO with the Securities and Exchange Board of India last week.

By choosing the confidential route for its IPO filing, Zepto has the flexibility to maintain the privacy of its financial details until the official launch of the IPO. This approach aligns with the company’s strategic decisions to carefully navigate the complexities of the IPO process while keeping stakeholders informed at the right time.

Market analysts and industry experts closely monitor the developments, projecting a positive outlook for the company’s IPO. With the quick-commerce sector in India witnessing rapid growth and evolving consumer trends, Zepto’s IPO is poised to draw significant interest from investors looking to capitalize on the expanding market opportunities in the country.

Comments are closed.